The Federal Circuit recently clarified what patents are subject to the Transitional Program for Covered Business Method Patents, or CBM review, in Secure Axcess, LLC v. PNC Bank National Association.[1] In clarifying what patents are subject to CBM review, the Federal Circuit reversed the Patent Trial and Appeals Board (“Board”) conclusion that U.S. Patent No. 7,631,191 (“’191 patent”) is a CBM patent.

CBM Review

CBM review allows a party to challenge the validity of a patent under a broader range of statutory provisions than the more common Inter Partes Review (IPR) procedure. Specifically, in a CBM review, patent claims can be challenged for being (i) directed to unpatentable subject matter,[2] (ii) anticipated by a prior art reference,[3] (iii) obvious over a combination of prior art references,[4] or (iv) indefinite or not properly supported or enabled.[5] However, CBM review is limited to patents that claim “a method or corresponding apparatus for performing data processing or other operations used in the practice, administration, or management of a financial product or service.”[6]

Overview of the ’191 Patent

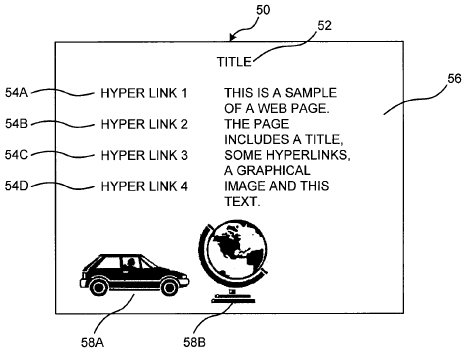

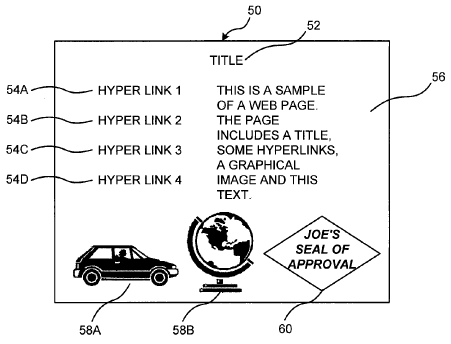

The ’191 patent relates to web page authentication. As shown in FIGS. 1 and 2 of the ’191 patent, reproduced below, an authenticated web page (FIG. 2) includes an authenticity stamp 60 in addition to the information presented in the web page without the authentication (FIG. 1).

Board Concludes ’191 Patent is Eligible for CBM Review

In its final written decision,[7] the Board noted that the specification of the ’191 patent discloses a need for web page authentication by financial institutions and provides example uses by financial institutions.[8] The Board further reasoned that because the ’191 patent claims a particular manner of authenticating a web page,[9] the ’191 patent is “directed to solving problems related to providing a web site to customers of financial institutions,” and therefore “covers the ancillary activity related to a financial product or service of Web site management and functionality.”[10] The Board then concluded that “the method and apparatus of the ’191 patent perform operations used in the administration of a financial product or service,”[11] and maintained that the ’191 patent is eligible for CBM review. The Board also noted that the patent owner’s litigation history, which included patent infringement suits against approximately 50 financial institutions, is “a factor weighing toward the conclusion that the ’191 patent claims a method or apparatus that at least is incidental to a financial activity.”[12]

Federal Circuit Reverses Board’s Conclusion

On appeal, the Federal Circuit stated that the statutory definition of a CBM patent requires not only that a patent claim (i) a method or corresponding apparatus for performing data processing or other operations, but it must also claim (ii) use of such method or apparatus in the practice, administration, or management of a financial product or service in order to qualify as a CBM patent.[13] According to the Federal Circuit, “[i]f that use does not have to be part of the claim as properly construed, essentially every patent could be the subject of a CBM petition.”[14]

Rejecting other inquiries such as whether the patent claims activities or operations “incidental to” or “complementary to” a financial activity as being overly broad, the Federal Circuit explained that the patent must have “a claim that contains, however phrased, a financial activity element,”[15] and that “the written description alone cannot substitute for what may be missing in the patent ‘claims.’”[16]

Based on this interpretation, the Federal Circuit held that the ’191 patent did not contain a single claim that could qualify the patent as a CBM patent and reversed the Board’s conclusion that the ’191 patent is eligible for CBM review.

Conclusion

In Secure Axcess, the Federal Circuit made clear that for a patent to be subject to CBM review, a patent must have a claim that contains a financial element. This decision will likely reduce the number and success rate of CBM petitions going forward and provides clear guidance for patent applicants wishing to avoid CBM review.

[1] Secure Axcess, LLC v. PNC Bank Nat’l Ass’n, No. 2016-1353 (Fed. Cir. Feb. 21, 2017).

[2] 35 U.S.C. § 101.

[3] 35 U.S.C. § 102.

[4] 35 U.S.C. § 103.

[5] 35 U.S.C. § 112.

[6] The Leahy-Smith America Invents Act § 18(d)(1).

[7] PNC Bank, N.A. v. Secure Axcess, LLC, CBM2014-00100 (hereinafter “CBM Review”).

[8] Id. at 10.

[9] Claim 1 of the ’191 patent:

A method comprising:

transforming, at an authentication host computer, received data by inserting an authenticity key to create formatted data; and

returning, from the authentication host computer, the formatted data to enable the authenticity key to be retrieved from the formatted data and to locate a preference file,

wherein an authenticity stamp is retrieved from the preference file.

Claim 17 of the ’191 patent:

An authentication system comprising:

an authentication processor configured to insert an authenticity key into formatted data to enable authentication of the authenticity key to verify a source of the formatted data and to retrieve an authenticity stamp from a preference file.

[10] CBM Review at 10.

[11] Id. at 11.

[12] Id.

[13] See Secure Axcess at 12-15.

[14] Id. at 14.

[15] Id. at 19.

[16] Id. at 14.